8 key investment themes for 2020

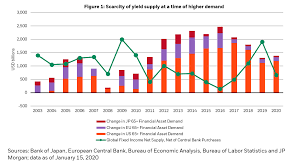

In our industry, we can safely rely on the turn of the calendar year to bring with it an overflowing inbox of â??bold callsâ? for year ahead. Through the barrage of 2020 predictions, sector bets, benchmark target revisions, and the like, we are struck by the sobering reality that it will be incredibly difficult for asset markets to repeat the heroic returns of 2019 this year. Notwithstanding a fundamental environment that appears to be stabilizing, more dovish global central banks, and a meaningful reduction in trade tensions, fulsome market valuations abound, leaving less room for upside and little margin of safety should any of these influences reverse, or should unforeseen new risks arise.

As such, we think a 4% to 5% returning portfolio would be a winner in fixed income in 2020. Our â??Drive for 5(%)â? centers around building a barbell portfolio, underpinned on one side by high quality fixed income, with carefully selected equity and alternative assets on the other. This portfolio mix will be instrumental in successfully navigating a macro environment that is likely to be dominated by eight major influences

U.S. life insurance industry ad spend 2018-2020 Published by A. Guttmann, Sep 5, 2019 In a survey of representatives of the life insurance industry in the United States, it was found that in 2018 the sector spent 9 million U.S. dollars on advertising, and based on this data it was projected that the expenditures would rise to 9.07 million U.S. dollars in 2020. Advertising spending in the life insurance industry in the United States from 2018 to 2020

In a survey of representatives of the life insurance industry in the United States, it was found that in 2018 the sector spent 9 million U.S. dollars on advertising, and based on this data it was projected that the expenditures would rise to 9.07 million U.S. dollars in 2020.

2019-2020 US Financial Year Planner Diary: 15 Months-October 19 to December 20 | Flexible Personal Fiscal Period | Ideal Small Business | Unique Stylish Cover

Handy Size 6 X 9 - Small Business or Personal Financial Year Diary - October 2019 to December 2020

Keep track of all your personal and financial transactions for 2019-2020 including

Tag: us bank car loan

How to Get a Car Loan in the USA

Overview You might think that most people don’t take an interest in driving a brand […]

US home loan applications drop to the lowest since 2015 as the coronavirus pandemic continues to weigh on the housing market

- The US home loan purchase index fell 12% in the week ending April 3 to its lowest point since 2015, according to a Wednesday survey from the Mortgage Bankers Association.

- Mortgage applications also declined nearly 18% last week on an adjusted basis, and refinancing applications fell 19% in the same period but are still up on the year.

- “Given the ongoing rate volatility, along with the persistent lack of liquidity in certain sectors of the MBS market, we expect to see continued weekly swings in refinance activity,” said Joel Kan of the MBA in a statement.

- Read more on Business Insider.

Economic fallout due to the coronavirus pandemic is weighing on potential homebuyers in the US.

Which Premium Travel Credit Card For 2020 After Chase Increases Fee For The Sapphire Reserve Card To US$550?

There will be some added benefits that are rather mediocre and in most cases not worth an additional $100 in fees if anything at all.

With the new annual fee of US$550 the card is on the same level as the American Express Platinum but without the value added benefit of airport lounges and (let’s face it) the prestige that still comes with an Amex Platinum card.

Venture® from Capital One®

Enjoy a one-time bonus of 50,000 miles once you spend $3,000 on purchases within 3 months from account opening, equal to $500 in travel -Earn unlimited 2X miles per dollar on every purchase, every day -New! Earn 10 miles per dollar on hotels when you pay with your Venture card at hotels.com/venture; learn more at hotels.com/venture -Fly any airline, stay at any hotel, anytime -travel when you want with no blackout dates -Miles won't expire for the life of the account and there's no limit to how many you can earn -No foreign transaction fees -$0 intro annual fee for the first year; $95 after that

Citi Simplicity® Card

Citi Simplicity® Card The ONLY card with No Late Fees, No Penalty Rate, and No Annual Fee…EVER. 0% Intro APR on Balance Transfers and Purchases for 18 months. After that, the variable APR will be 15.49% - 25.49?sed on your creditworthiness* There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

BankAmericard

Save on interest to help pay down your balance faster: No annual fee. 0% Intro APR† for 15 billing cycles for purchases, and any balance transfers made in the first 60 days of opening your account. After that, a Variable APR that’s currently 14.49% - 24.49% will apply. $0 Intro balance transfer fee for the first 60 days your account is open. After that, the fee for future balance transfers is 3% (min. $10).

Bank of America Premium Rewards Credit Card

With low annual fee of $95, receive 50,000 bonus points- a $500 value - after you make at least $3,000 in purchases in the first 90 days of account opening. No limit to the points you can earn and your points don't expire!

Chase Sapphire Preferred Credit Card

$0 Foreign Transaction Fees, $0 Intro Annual Fee for the first year, then $95